RU² / February 14, 2024

New Home Lot Supply Index

Original Article: Zonda: New Home Lot Supply Index

The New Home Lot Supply Index provides an unrivaled look into the lot markets across the country, offering a current quarter snapshot as well as insight into the directional trend. This report details data for the fourth quarter of 2023.

The New Home LSI, backed by data from Zonda, showed lot supply loosened year-over-year across the United States, but tightened quarter-over-quarter. The index is a residential real estate indicator based on the number of single-family vacant developed lots and the rate at which those lots are absorbed via housing starts.

- The New Home LSI came in at 61.9 for 4Q23, representing a 25.1% increase from 4Q22. The 4Q23 data remains a “significantly undersupplied” market nationally.

- On a quarter-over-quarter basis, supply decreased by 3.2% from 3Q23.

- It is important to remember how this index is calculated. We consider the total vacant developed lot supply and adjust it for overall starts activity. The LSI started to roll over in 4Q23 as builders felt more confident increasing starts again.

“The market saw a brief reprieve in lot availability as starts slowed, but the fourth quarter data captures the return of tightening as builders step up construction activity,” said Ali Wolf, chief economist at Zonda. “75% of builders intend to start more homes in 2024 compared to 2023, and those starts require lots. The lingering issue is how today’s lot pricing plays into housing affordability going forward.”

Lot supply loosened in most major metropolitan areas in 4Q23, with 24 of 30 increasing year-over-year, down from 29 last quarter.

- Lot inventory is still categorized as “significantly undersupplied” in most markets. The loosening trend year-over-year is simply a function of the softness in the market in 4Q22.

- As of the fourth quarter, there were four markets labeled “appropriately supplied” and three considered “slightly undersupplied.” Know that being categorized as “appropriately supplied” doesn’t mean these markets are flush with lots. It just captures a more tempered and healthier pace of lot conversion compared to the height of the market.

- The markets where land supply loosened the most on a year-over-year basis were led by Phoenix, Nashville, and Charlotte. In these markets, starts were up 47%, 13%, and 4%, respectively, compared to the same quarter last year.

- Los Angeles/OC tightened the most compared to the same time last year, falling 55% to 16.9. Los Angeles/OC is now the tightest housing market across the country for lot supply. Besides Los Angeles/OC, Miami and San Diego are also among the tightest in the nation. All three markets have severe geographic and topographical limitations on land and lot development.

- The LSI tightened quarter-over-quarter in 22 of Zonda’s select 30 markets, mirroring the national trend.

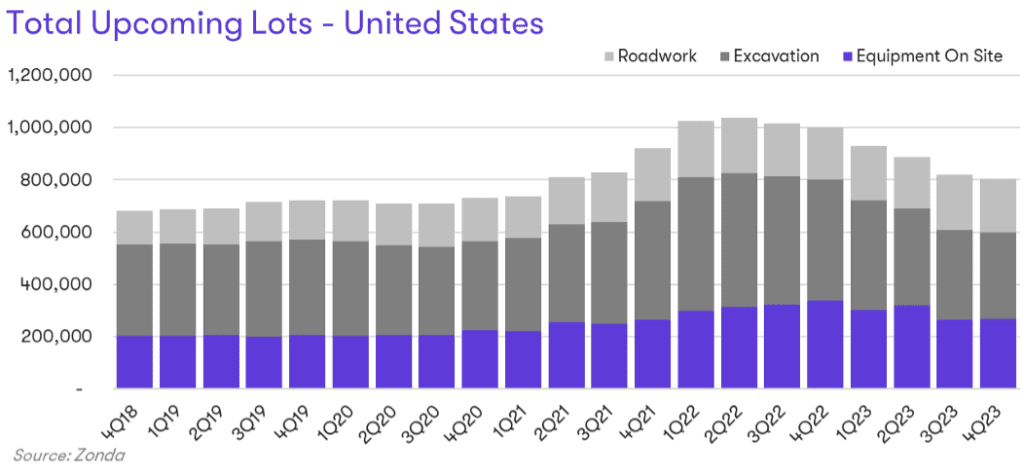

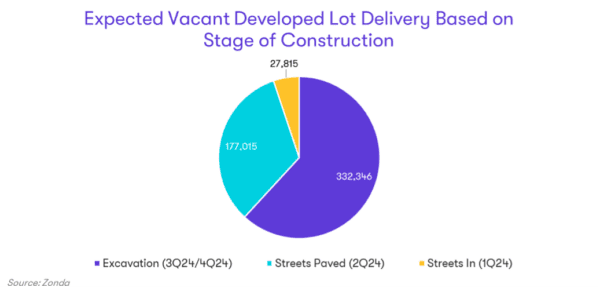

Zonda also records future lots through the stages of development. The stages range from raw land through streets in, which is the last step before the lot becomes a vacant developed lot. Zonda groups the last few stages into a classification called total upcoming lots, which typically indicates delivery over the next 12-18 months.

Total upcoming lots for 4Q23 decreased 20% year-over-year and fell 2% from last quarter. The largest decline among the total upcoming lots came in the excavation stage, which fell 29% from the same period last year. The pullback in total upcoming lots in the third quarter corresponds with the market demand pullback seen at the end of ’22 and early ’23.

The largest share of total upcoming lots was in the excavation stage in 4Q23, making up 62% nationally. These lots have an expected delivery between 3Q24 and 4Q24 (the range represents different timeframes from local entitlement processes). Note, that not all the lots in excavation will match Zonda’s estimated timeline.

“Context is important when looking at total upcoming lots,” Wolf said. “While the graph shows a notable pullback in the most recent data, total upcoming lots are 11% above the same time in 2019. For context, new home sales finished the year exactly in line with 2019 levels. Current lot development is supportive of modest growth in the new home market but doesn’t support blockbuster growth.”

« Previous